by Patten Mills | 3 min. read

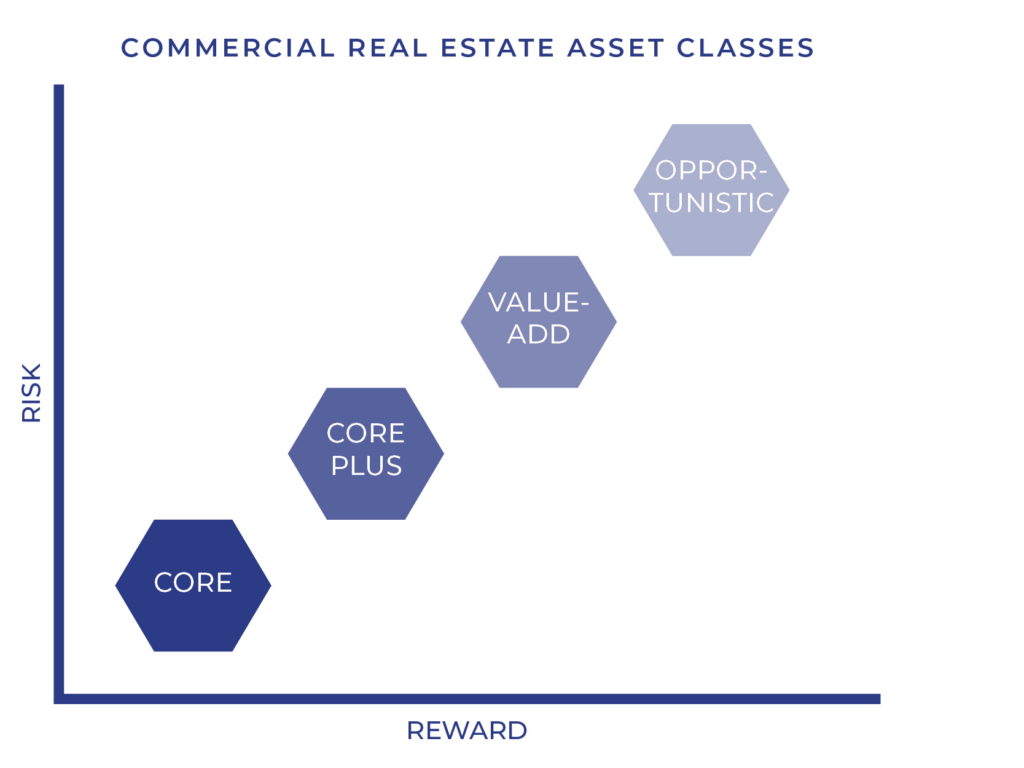

Investment properties look substantially different to someone who intends to be a passive investor and realize an immediate cash flow compared to the risk-taker with a vision who is willing to make a gamble in hopes of high returns. Factors used to measure risk such as the property’s physical condition, location, occupancy level, tenant creditworthiness, length of leases, and financing plan play important roles in the evaluation of risk-verses-reward. Core, core plus, value-add, and opportunistic investment properties are ways of categorizing commercial real estate assets on a scale of volatility of return, with core and core plus properties generally representing the low and low to moderate risk end of the continuum.

CORE PROPERTIES: Slimmer Returns for Safer Investments

Any type of investment real estate from office and industrial to retail, mixed-use, and multifamily can be categorized within the spectrum of core to opportunistic. In a range of conservative to aggressive, core properties are considered the safest real estate investments. Core properties can be an alternative to bonds for conservative investors. Their relative lack of volatility and resilience during economic downturns can also help offset riskier ventures in a diverse real estate portfolio. Typically characterized by creditworthy tenants with long term leases and little to no vacancy, these properties are usually in prime locations and well-maintained with negligible deferred maintenance or owner responsibility. The low risk of core properties relative to the other categories of investment properties results in lower cap rates, a metric that reflects the risk and return of an investment property and inversely impacts the price. Single tenant net lease and turnkey multifamily properties are two examples of real estate investments that can be considered core properties, and both trade at relatively low cap rates.

Single tenant net lease properties are known to sell at the lowest cap rates of investment real estate because these lease structures leave minimal maintenance responsibility on the owner and tend to have longer term leases, making them desirable as a passive income stream. Similar to government bonds that are considered one of the safest investments because they have the backing of the full faith and credit of the U.S. government, single tenant net leases are often guaranteed by the full faith and credit of the corporation behind the occupant. Cap rates within this product type vary based on creditworthiness of the tenant. For instance, real estate leased to CVS is known to trade at a lower cap rate than Rite Aid. In July 2021, Fitch Ratings discussed Rite Aid’s credit rating compared to its peers and provides insight into why that is, such as the corporation’s Long-Term Issuer Default Rating of B-, minimal to negative cash flow, and significantly higher leverage profile than competitors.1 According to CoStar analytics, the average cap rate of Rite Aid investment sales within the past two years was 7.7%. Meanwhile, the average cap rate for CVS was 5.7%.2 While cap rates vary depending on market conditions, the difference in these averages provides insight into the differing strengths of these tenants, which results in varying levels of risk even within the core property category.

While multifamily properties leave much more maintenance responsibility to the owner, residential investment is inherently safer than commercial given that housing can be viewed as a commodity. Multifamily properties with management in place that are well located, well maintained, and have high occupancy could also be considered core properties and provide a passive income stream like single tenant net leases. The average cap rate for multifamily properties sold in PA within the past two years was 7.6% based on CoStar data.3

Given that these properties are already stabilized upon acquisition, the return from core properties primarily derived from cash flow rather than appreciation. The low risk of single tenant net lease and multifamily properties keeps cap rates low and, therefore, the margin of return slim. The financing terms a particular investor can obtain might determine whether an investment makes sense. Too high of an interest rate could reduce profit, perhaps making it more logical to allocate the capital elsewhere, such as in stocks or bonds. On the other hand, low interest rates and depreciation could result in returns significantly higher than securities would yield.