by Katie Spurrier | 6 min. read

by Katie Spurrier | 6 min. read

____________________

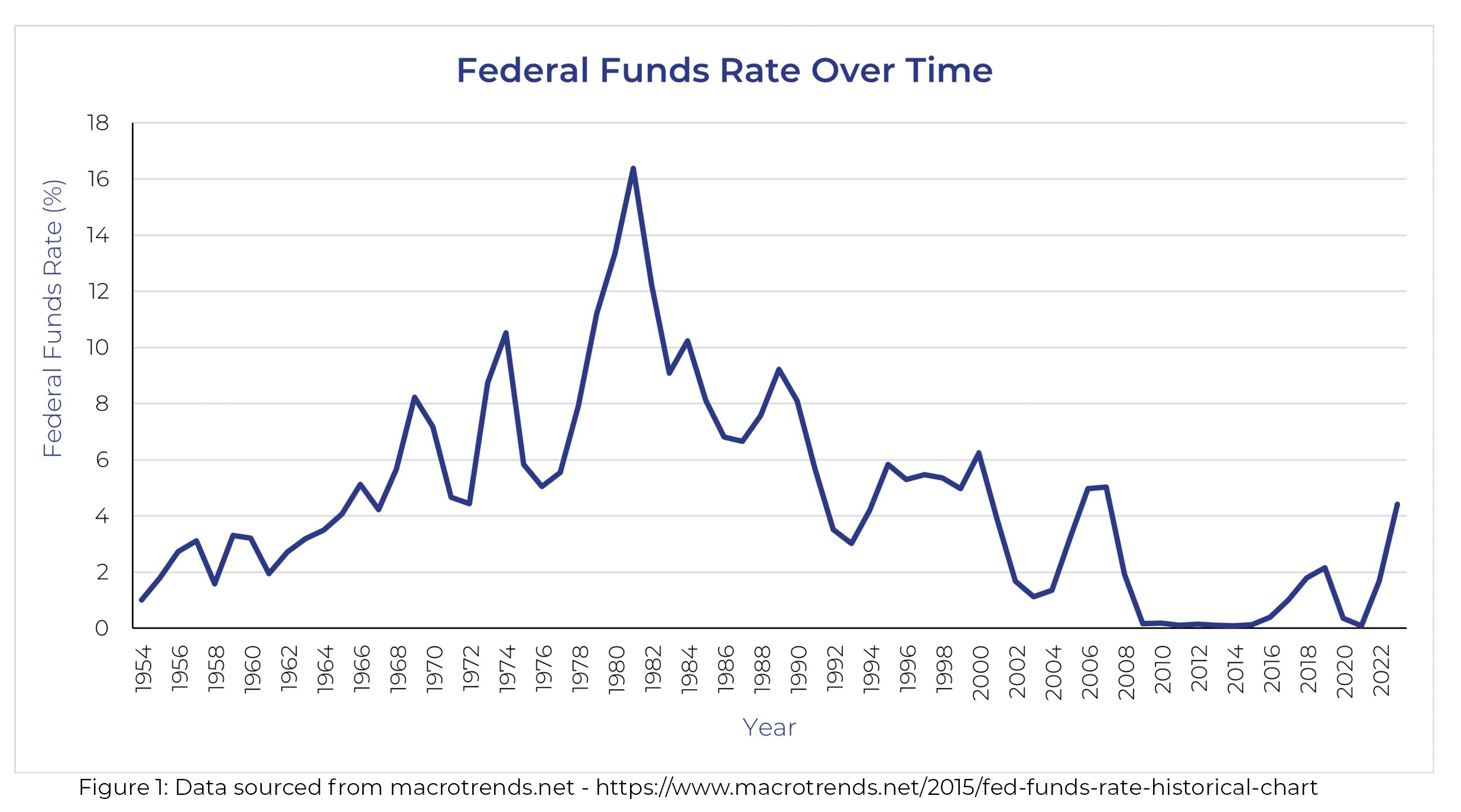

At the conclusion of their meeting in February, the Fed decided to raise the benchmark interest rate 0.25% (+25 basis points). This is the eighth increase since March 2022 to combat historically high inflation not seen since the early 1980s (Figure 1). Of course, recent inflation began after the COVID-19 pandemic due to supply chain issues and rising costs for goods and services. Food prices have increased more than 10% over the last calendar year. Eggs are now 60% more expensive than they were a year ago, butter is up 31%, and lettuce has jumped 25%. Recently, gas prices have again increased 30 cents over the past month hovering at a national average of $3.50 per gallon.1 The Fed has an aggressive plan to reduce inflation to a target rate of 2%, but Federal Reserve Chairman Jerome Powell believes it will take time. At a press conference days after the most recent hike, he suggested further rate increases are likely, and the process of disinflation will continue into 2024.2 How does this rapidly rising interest rate environment impact commercial real estate financing and CAP rates?

Rising interest rates have made commercial real estate financing more expensive for investors. According to the Mortgage Bankers Association (MBA), total multifamily and commercial lending fell by 17.3% in 2022, from $895B to $740B. In 2023, the MBA predicts lending volume will fall by another 4.7% to $700B.3 Generally, borrowing costs follow the same trends as the rate on the 10-year treasury yield. Treasury bonds (T-bonds) are long-term government securities issued for 20-30 years. T-bonds pay interest every 6 months and return to face value once matured. The 10-year treasury yield is the current rate treasury notes would pay investors if they bought them today.

Rising interest rates have made commercial real estate financing more expensive for investors. According to the Mortgage Bankers Association (MBA), total multifamily and commercial lending fell by 17.3% in 2022, from $895B to $740B. In 2023, the MBA predicts lending volume will fall by another 4.7% to $700B.3 Generally, borrowing costs follow the same trends as the rate on the 10-year treasury yield. Treasury bonds (T-bonds) are long-term government securities issued for 20-30 years. T-bonds pay interest every 6 months and return to face value once matured. The 10-year treasury yield is the current rate treasury notes would pay investors if they bought them today.

Fluctuations in the 10-year treasury yield can be an economic benchmark. For example, on July 5, 2016, the 10-year treasury yield fell to a formerly record low of 1.37% in response to citizens of the United Kingdom voting to leave the European Union. On March 9, 2020, the 10-year treasury yield reached an all-time low of 0.54% as global markets responded to the COVID-19 pandemic. 10-year treasury yields influence many other interest rates.4 The market interest rate for commercial real estate financing is calculated using the 10-year treasury data and adding a spread to determine the rate paid by the investor. In early 2022, the short-term financing interest rate was around 3.5% determined by adding the 10-year treasury rate to the average spread of 2.01% reported by GlobeSt. Just a few months later, the interest rate had increased to 4.61% midyear 2022.5

Increasing borrowing costs negatively affect investment cash flow. In the Forbes article, “Dissecting The Impact of Increased Borrowing Costs on Commercial Retail Properties,” author Jared Feldman illustrates the following example. Consider an investor purchases a commercial property for $10M with financing at 3.75% interest for a 10-year term. The interest payment for the first month is $20,312 ($6.5M x 3.75% / 12 months). Increasing the interest rate to 5.75% results in a $31,146 interest payment for the first month ($6.5M x 5.75% / 12 months). A 2% increase in interest rate raises the interest charge by nearly $11,000 in the first month. Unsurprisingly, this interest rate increase directly reduces an investor’s cash flow after accounting for all operating expenses.

However, a notable benefit of increasing interest rates is their inverse relationship with asset values. When interest rates rise, asset values decrease. In an environment where interest rates increase rapidly, property values generally decrease to make up for lower cash flows.5 Savvy investors know this and oftentimes wait it out. Several experts are citing this current trend where there is debt capital available, but few investors are willing to transact unless they have to, and if they do, there is an increase in private capital and loans from regional/local banks to fund the deals.6

Another commercial real estate performance measure is the CAP rate. CAP rates explain the relationship between a property’s net operating income (NOI) and its market value (NOI/market value x 100 = __%). Generally, it is the expected yearly return rate if the property was a cash purchase. In other words, it can signify the risk of purchasing a commercial real estate asset.7 Although a valuable indicator, CAP rates are not fixed and fluctuate over the life of the investment due to several conditions. Some are hyper-specific like exact location. However, broader elements normally increase or decrease CAP rates. Steve Gilbert, Director of Applied Modeling and Analytics for J.P. Morgan Investment Banking, states CAP rates are generally a reflection of larger economic factors in response to market conditions. These macroeconomic factors include rising interest rates, rent growth, changes in gross domestic product (GDP) and unemployment, and asset class.8

Both rising interest rates and increasing rents have a positive correlation with CAP rates. As interest rates rise, CAP rates typically rise too. Over the short term, CAP rates tend to increase by a smaller margin than interest rates, oftentimes by less than 1%. This increase is heavily dependent on other conditions like the strength of the local economy and supply and demand balance. Throughout 2022, the relationship between interest rates and CAP rates was not always positive. Nationally, CAP rates for industrial and multifamily properties were slow to increase, but in the second and third quarters of 2022, CAP rates began to rise due to continued interest rate increases and general concern about the economy.8 This trend reflects the increased costs of commercial real estate financing, indicating returns need to increase to maintain the same level of profitability for the cash investor.7 Similarly, rent growth can accelerate during times of high inflation and increased CAP rates. In fact, ROCK’s Q4 2022 market reports saw 12-month rolling average rent increases across all property types (industrial, office, and retail) in both York and Lancaster Counties.

ROCK Managing Partner David Bode, CCIM, SIOR, had this to say about market conditions: “The rapidly rising interest rate environment is certainly having an effect on the investment side. CAP rates are beginning to rise even on long term national deals, and some of these properties are not selling quickly or are still on the market. I think it may cause investors to pause to see how high interest rates go before reentering the market to begin buying investments at a more affordable price. Some investors do not necessarily need financing so they can refinance years later at lower interest rates. I believe you will see more activity as long as sellers agree to sell at higher CAP rates. Long story short, I think we are at a time where CAP rates are still lower than what investors want, and the sellers are beginning to reduce their prices but slowly in order to test the market to see where it ultimately lands.” It is important to note CAP rates are not the only indicator of profitability and don’t account for future appreciation of property values.

The brokerage advisors at ROCK are here to help you assess the level of risk with investment properties and navigate changing local market conditions. CONTACT US with any questions.

SOURCES

1 Cox, Jeff. (2023, February 1). Fed Raises Rates a Quarter Point, Expects ‘Ongoing’ Increases. Retrieved from https://www.cnbc.com/2023/02/01/fed-rate-decision-february-2023-quarter-point-hike.html

2 Cox, Jeff. (2023, February 7). Fed Chair Powell Says Inflation is Starting to Ease, but Interest Rates Still Likely to Rise. Retrieved from https://www.cnbc.com/2023/02/07/fed-chief-powell-says-the-the-disinflationary-process-has-begun-but-has-a-long-way-to-go.html

3 Lasalvia, Thomas; Villa, Nick; and, Rosin, Christopher. (2023, January 31). And, What Comes Next for Commercial Real Estate? Retrieved from https://cre.moodysanalytics.com/insights/cre-news/cre-market-needs-clarity-from-the-fomc-will-it-get-it/?utm_medium=Social&utm_campaign=Weekly_Update&utm_source=Twitter&utm_content=&utm_term=FOMC

4 Baldridge, Rebecca. (2023, January 20). Understanding the 10-Year Treasury Yield. Retrieved from https://www.forbes.com/advisor/investing/10-year-treasury-yield/

5 Feldman, Jared. (2022, December 15). Dissecting the Impact of Increased Borrowing Costs on Commercial Retail Properties. Retrieved from https://www.forbes.com/sites/forbesfinancecouncil/2022/12/15/dissecting-the-impact-of-increased-borrowing-costs-on-commercial-retail-properties/?sh=5da583305d55

6 Bergeron, Paul. (2023, February 7). Private Capital, Regional and Local Banks Step Up to Make Loans. Retrieved from Bergeron, Paul. (2023, February 7). Private Capital, Regional and Local Banks Step Up to Make Loans. Retrieved from https://www.globest.com/2023/02/07/private-capital-regional-and-local-banks-step-up-to-make-loans/?kw=Private%20Capital%2C%20Regional%20and%20Local%20Banks%20Step%20Up%20to%20Make%20CRE%20Loans&utm_source=email&utm_medium=enl&utm_campaign=nationalamalert&utm_content=20230207&utm_term=rem&enlcmp=nltrplt4

7 First National Realty Partners Blog. (2021, August 4). Cap Rate Expansion vs. Compression Explained. Retrieved from https://fnrpusa.com/blog/cap-rate-expansion-vs-compression/#:~:text=Cap%20rate%20expansion%20%E2%80%93%20higher%20cap,to%20rising%20real%20estate%20values

8 JP Morgan Chase Blog. (2022, November 1). The Role of CAP Rates in Real Estate. Retrieved from https://www.jpmorgan.com/commercial-banking/insights/cap-rates-explained